Newsletter Archive

The Rodney White Center’s newsletter, A Bite of Finance is now incorporated into the Frontier of Finance. View past issues of A Bite of Finance on this page.

FEBRUARY ISSUE

2024

THE RODNEY WHITE CENTER FOR FINANCIAL RESEARCH

A Bite Of Finance: The Latest From Wharton

FEATURE

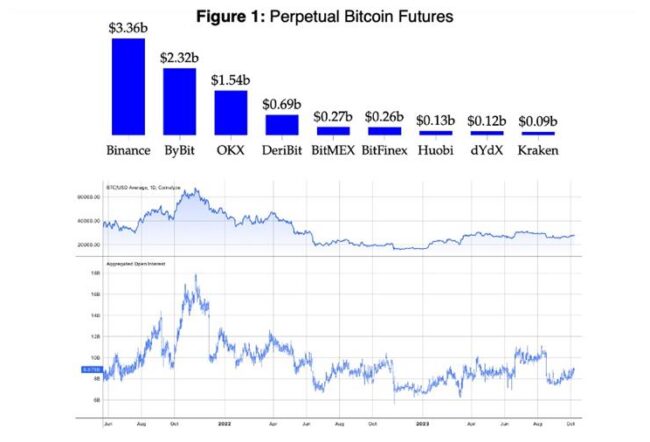

Deriving Expressions for the No-arbitrage Price of Perpetual Contracts

Perpetual Futures Pricing

Damien Ackerer, École Polytechnique Fédérale de Lausanne

Julien Hugonnier, École Polytechnique Fédérale de Lausanne

Urban Jermann, The Wharton School

ARTICLE

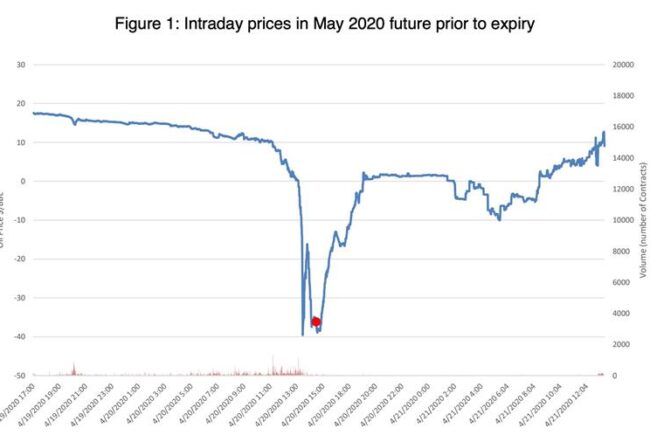

What Happens when the Benchmark Price for Crude Oil Falls Below Zero?

When Benchmarks Fail: The Causes and Consequences of Negative Oil Prices

Erik Gilje, The Wharton School

Robert C. Ready, University of Oregon

Nikolai L. Roussanov, The Wharton School

Jérôme Taillard, Babson College

ARTICLE

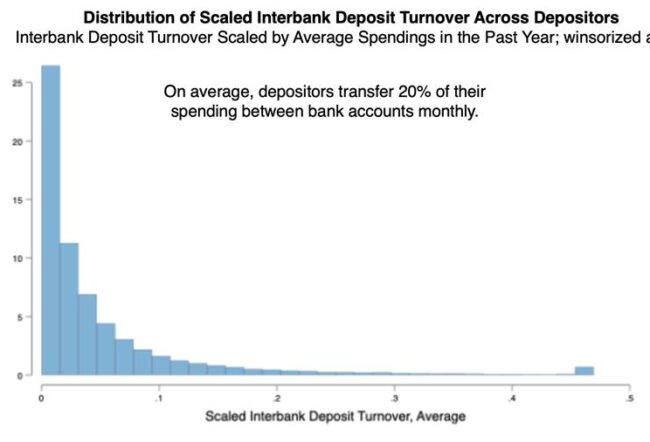

Challenging the Traditional View of Depositor Sleepiness

The Making of an Alert Depositor: How Payment and Interest Drive Deposit Dynamics

Xu Lu, University of Washington

Yang Song, University of Washington

Yao Zeng, The Wharton School

ARTICLE

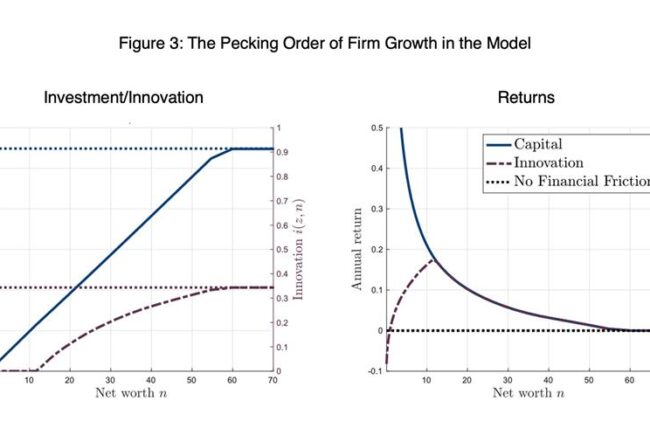

The Role of Financial Frictions in Determining the Allocation of Investment and Innovation

Capital, Ideas, and the Costs of Financial Frictions

Pablo Ottonello, University of Maryland and the National Bureau of Economic Research

Thomas Winberry, The Wharton School and the National Bureau of Economic Research

ARTICLE

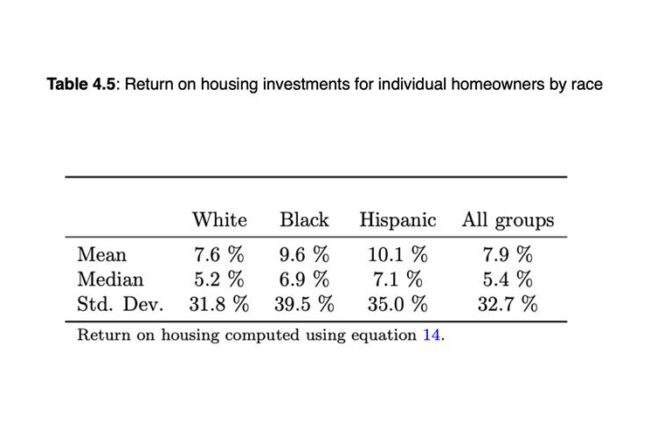

Assessing Racial Disparities in the Return on Homeownership

Racial Differences in the Total Rate of Return on Owner-Occupied Housing

Rebecca Diamond, Stanford Graduate School of Business and

the National Bureau of Economic Research

Will Diamond, The Wharton School

Recent Past Issues

DECEMBER 2023

In this issue: dollar asset holding and hedging around the world; the effect of monetary policy on mortgage rates; corporate responses to stock price fragility; mental accounting and total consumption expenditure; and the connection between consumer surveillance and financial fraud.

SEPTEMBER 2023

In this issue: FinTechs and the collateral channel; market collusion from AI trading; the role of investor expertise in green energy development; optimal capital regulation modeling; and the skewness of firm growth during recessions.

JULY 2023

In this issue: looking at how much ESG investing there really is, post-COVID stimulus measures, exploring the “factor zoo” and the robustness of stock return anomalies, trade credits, and how interest rates react to financial instability.

MAY 2023

In this issue: preventing bank failures, mortgage lock-in, the feedback loop between financial distress and competition, stablecoin runs, and the benefits of bank diversification.

MARCH 2023

In this issue: the sources of extreme wealth, 170 years of economic sentiment, the effects of the minimum wage on low-income workers, the advantages of trading with expert dealers, and asset concentration in OTC markets.

JANUARY 2023

In this issue: racial bias in bankruptcies, imperfect competition in the repo market, behavioral biases in the housing market, optimal strategies for crypto issuers, and the value of undiversified shareholder engagement.

NOVEMBER 2022

In this issue: How does democracy impact the stock market? Do growth stocks really have higher growth? How does under-diversification affect the economy? Who owns government debt? How passive are passive ETF

SEPTEMBER 2022

In this issue: a challenge to the risk-return tradeoff, the sources of wealth inequality, the effects of underfunded state pensions on households, the sensitivity of bank deposits to transparency, and arms sales in financial markets.

JULY 2022

In this issue: the impacts of impact investing, collusion in the distressed-loan market, the macro effects of aging, new predictability in stock market returns, and political pushback to ESG.

MAY 2022

In this issue: the economic effects of Roe v. Wade, the active side of passive ETFs, the post-LIBOR world, risk anomalies in stock returns, and the effects of interest rates on bank lending.

MARCH 2022

In this issue: the link between volatility and liquidity; the unintended consequences of Quantitative Easing; why some households hold more stocks than others; how size matters in bond trading; and the effects of technological progress on rent-seeking.

JANUARY 2022

In this issue: paying off the national debt, the effect of rising sea levels on muni bonds, gold’s value as an investment, the effects of capital controls on currency crises, and the environmental impacts of private equity.

NOVEMBER 2021

Reassessing stock versus bond performance, synergies in FinTech lending, fracking’s long-term effects, the performance of ESG strategies, and PE investors’ effects on healthcare costs

SEPTEMBER 2021

New findings on CEO stress, mutual fund flows, distressed stock returns, cash windfalls and entrepreneurship, information technology, and expectation errors

JULY 2021

Professor Erik Gilje organized a Virtual Conference on Climate and Commodities that took place on April 23 and included a panel discussion with Professor Jeremy Siegel.

Research includes important studies on inflation risks for investors and the recent behavior of the Yuan; a truly insightful new discussion on how government intervention can impact the renegotiation of private debts and help stop default waves across linked borrowers; as well as a historical assessment of the role of banks in pre-WWI sovereign defaults.

MAY 2021

Student loan forgiveness, decline in Entrepreneurship and collateralized debt obligations

MARCH 2021

Social Security, bank debt, COVID -19 financial fragility, venture capitalists and more

JANUARY 2021

COVID-19 bailouts, financing education and re-examining history

SUBSCRIBE

If you would like to receive Finance at Wharton’s newsletter, click on the link below to be added to our mailing list.